Photo by: Nathália Bariani

Capturing the essence of an entire generation is a challenging task. On an individual level, there are too many exceptions. But so long as we look from a distance, the descriptions apply.

A life modeled after what they remember as having the most merit: a stable home, a decent job, a loving wife… and kids. These were their goals, the things they felt constituted a good life, and they achieved them. The “Greatest Generation” got their homes, good jobs, and kids. Lots of kids. Birth rates in the US zoomed up, and not just that, but infant mortality was falling, so more babies survived. Hence, the “boom” in the baby boom.

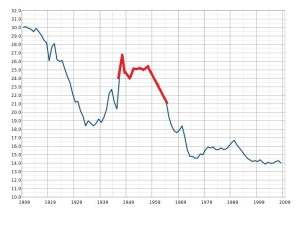

On a graph of birth rates per 1,000 (the red portion) the baby boom shows as a significant bump up. And the previous high rates from the early 1900’s are misleading. A lot of those folks have died (the great flu, WWI, WWII, higher infant mortality). It’s not just how many babies are born, but how many make it to adulthood that influences the outcome.

On a graph of birth rates per 1,000 (the red portion) the baby boom shows as a significant bump up. And the previous high rates from the early 1900’s are misleading. A lot of those folks have died (the great flu, WWI, WWII, higher infant mortality). It’s not just how many babies are born, but how many make it to adulthood that influences the outcome.

Boomers are traditionally considered those babies born within the 18-year span of 1946 to 1964. That puts them between 51 and 69 years old now. And those numbers have some serious implications.

The Aging Baby Boomers

When they are younger, the boomers are growing up in relative luxury. They don’t experience the same struggle to survive as their parents. The goals of stable finances and family life have already been met. Medium incomes are rising (and will continue to rise for another 30 years). Life is good. Relative luxury abounds.

In this context, a kind of idealism emerges. Instead of struggling for basics, the young boomers will set out to remake the world. In many ways, they do. We credit them with advancing civil rights, ending the war in Vietnam, attention to women’s rights, and more recently, supporting rights for gays and aiding the push for marijuana decriminalization. On a darker note, there’s a strong element of distrust for government and a sometimes ridiculous level of consumerism. Living on credit emerges and savings rates fall. This is the generation that said, “Greed is good.”

In 2015, the boomers are either recently retired or approaching retirement. Age and practical life experience has tempered their drive to remake the world, even though they now occupy the positions of power. They have become “The Man” they once protested against. Their concerns are still reshaping the society around us, just not by way of mass protest, but in a rather more sedate fashion.

Here’s one example of how aging boomers changed the landscape: marijuana decriminalization.

Despite the often cited harms from the war on drugs, those aren’t new. Neither is general knowledge about marijuana – anyone who wanted to try it has. What’s new, and what drove decriminalization, is the use of marijuana as medicine. That opened the door. And in no small way, it was the now-aging boomers, faced with age-related ailments, who decided marijuana ought to be available.

Marijuana is useful in the treatment of glaucoma – a classic disease of the elderly. It’s also used to enhance pain relief, improve appetite, and excellent for the daily grind of arthritis. As the traditionalists die off and the boomers get older, you suddenly have enough votes to do what our grandparents couldn’t have imagined – make the “demon weed” legal.

The Bulge Starts to Topple

Twenty years from now, the boomers will be headed into their 70s, 80s and 90s. This means a significant portion of the workforce and population in general will be retired and looking for the benefits and services they want and need to get by. The two benefits of most concern are healthcare and social security. The worry is that this bulge in population will stress social safety nets to the limits, or even crash the system altogether.

We have something rather unique in our history going on. Four distinct generations are all living in the US at the same time. There are the parents of the boomers, the boomers themselves, their children (Generation X) and their children’s children (the Millennials). In the normal course of affairs, those still working pay for the social safety net of those retired. But median wages (adjusted for inflation) have fallen, and no one knows if there will be enough in the pot to support the boomer bulge when it retires.

As it stands, the system is built on the idea of ever increasing productivity, rising GDP, and reduced net costs for the basics. It works as long as enough excess is generated by taxes. Not so well when times are tough or when too many are demanding services too quickly.

Healthcare is especially problematic. We can’t seem to decide when enough is enough. And, true to their roots, boomers want more. They consume more healthcare than ever before – those artificial hips aren’t cheap, and we haven’t learned to die well. We live longer than ever. With the average lifespan pushing 80 years, living into ones mid-90’s isn’t out of reach for many boomers.

That’s the sad reality. More people needing more services with fewer resources to pay for them. The change in family structures feeds into this as well. It’s no longer common for aged parents to move in with their children. That buffer is gone.

Some Good News

It isn’t all doom and gloom. Baby boomers aren’t stupid, they know what’s coming. Although painted as a generation that never learned to save, at least some have invested in pensions and 401k plans. Savings have started to go up and living on credit is no longer so popular. They’ve accepted a lower standard of income and quit buying so many toys. Boomers are retiring later too. Families now don’t rely on a sole income – women have moved into the workforce in a big way. Productivity and hours worked have risen too.

Unfortunately, economists tell us these mechanisms will only delay the crisis, not mitigate it entirely. Eventually, everyone has to face end of life issues, one of which is depending on others for support.

Health delivery is already changing to meet these needs. The focus is shifting to chronic care and lifestyle diseases. Boomers are suffering the consequences of their lifestyle: higher rates of diet-driven diabetes and obesity, higher rates of hypertension, and higher cholesterol. The truly debilitating age-related diseases, like Alzheimer’s, cancer, and heart disease, are all hot topics for research, and progress is being made. There’s also a movement toward patient-controlled care, where patients are expected to take a willing role in their own treatment – a frank necessity as the number of patients increase faster than the number of skilled medical practitioners available. This too is a concern – you can’t simply create staff to fill an increasing need. It takes too long to train a medical professional. This is most apparent in the lack of available specialists, and this in an era where the elderly often have a complex combination of illnesses, ranging from arthritis through circulatory disease and psychological problems. It wouldn’t be uncommon for one patient to seek the services of four or five specialists.

Money

There are three pillars of retirement finances. Savings (low to none, mostly “banked” in home ownership), pensions (rarer than ever and smaller than ever), and social security. On paper, the social security system is fine. Except… a lot of what is in the fund is IOU’s from when money was transferred to other parts of the government. These are “iron clad” guarantees, and the estimate is (on paper) social security is good for at least 26 years. But where do the funds come from when needed if they have been replaced with IOU’s? Most likely, deficit spending.

When push comes to shove, the 75+ million boomers are going to vote with their own self interests in mind, and “damn the consequences.”

Will there be enough money? Economists vary on this. But all see a contraction in lifestyle spending and a huge upswing in needed services. Some predict a seniors-helping-seniors model, where the not-so-old take care of the much older (and are paid to do so). Some tell us that the demands might be spread out enough so we don’t have to deal with all the boomers as a package, but can take advantage of the 18-year spread in ages for the demographic.

Some look to the world beyond our shores, since the baby boomer phenomenon is largely US-centered. If we can spread the costs to other countries, we can dilute the problem. How might this happen? More and more seniors are finding the financial benefits of retiring outside the US make up for the difficulties of living in a foreign culture. Surprisingly, there are countries, hungry for US dollars, who even allow expatriates to buy into their universal healthcare systems.

Money is an area where lumping all the boomers into one pile doesn’t work well. Each tends to find their own answer – whatever fits their situation – without a catch-all available.

Knowns and Unknowns

At the end of the day, there are clear events and not-so-clear consequences. We know the baby boomer bubble will be reaching retirement and old age soon enough. We know there will be an increased demand for health services (especially geriatric care) and we know that most boomers don’t have the resources to fund their own retirement. We also know there are fewer young workers, with lower average wages, to fund the social safety net.

What we don’t know is exactly how this will all play out, what innovative answers will emerge and what boomers themselves will accept or reject. Stay tuned.